Wealth and Resilience

Keeping up with the news is hard, and we have decided to share reading notes of articles we think can be interesting to our clients, or more broadly to anyone thinking about preserving wealth, or wealth resilience.

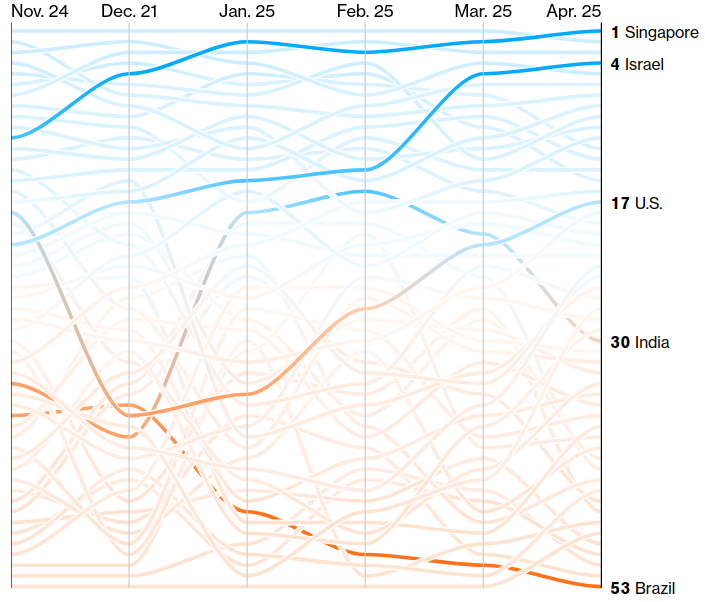

Bloomberg's COVID information is factual and thorough. Best of all, unlike the rest of its content it is free. Last month it published a COVID resilience ranking update that indicated that Singapore was the best place to be in during COVID times, taking over New-Zealand recently. The shift stems mostly from the much higher percentage of residents currently vaccinated.

Singapore is home to us, and beyond that continues to be in our mind one of the best, if not the best, option to execute wealth preservation strategies for international clients. Of course, we have a lot of excellent things to say about Singapore as a place to store precious metals, and gold specifically, but the wealth preservation environment is excellent beyond our focus.

Singapore GDP is expected to grow 5.8% in 2021, and the city-state is ideally placed to benefit economical rebounds of trading partners near and far. Investors are protected by an excellent legal system, and progressive regulators: the Monetary Authority of Singapore for fund managers but also digital assets, and Ministry of Law for precious metals.

Deloitte's report goes into much more detail as to why Singapore is a great place for family offices, and Sergey Brin's family office is opening in Singapore.

Fortunately, you don't need to be as wealthy as Brin to take advantage of Singapore's environment to preserve your wealth! Get in touch with our client team to explore our service offering, we'll be delighted to share our views, even beyond precious metals.